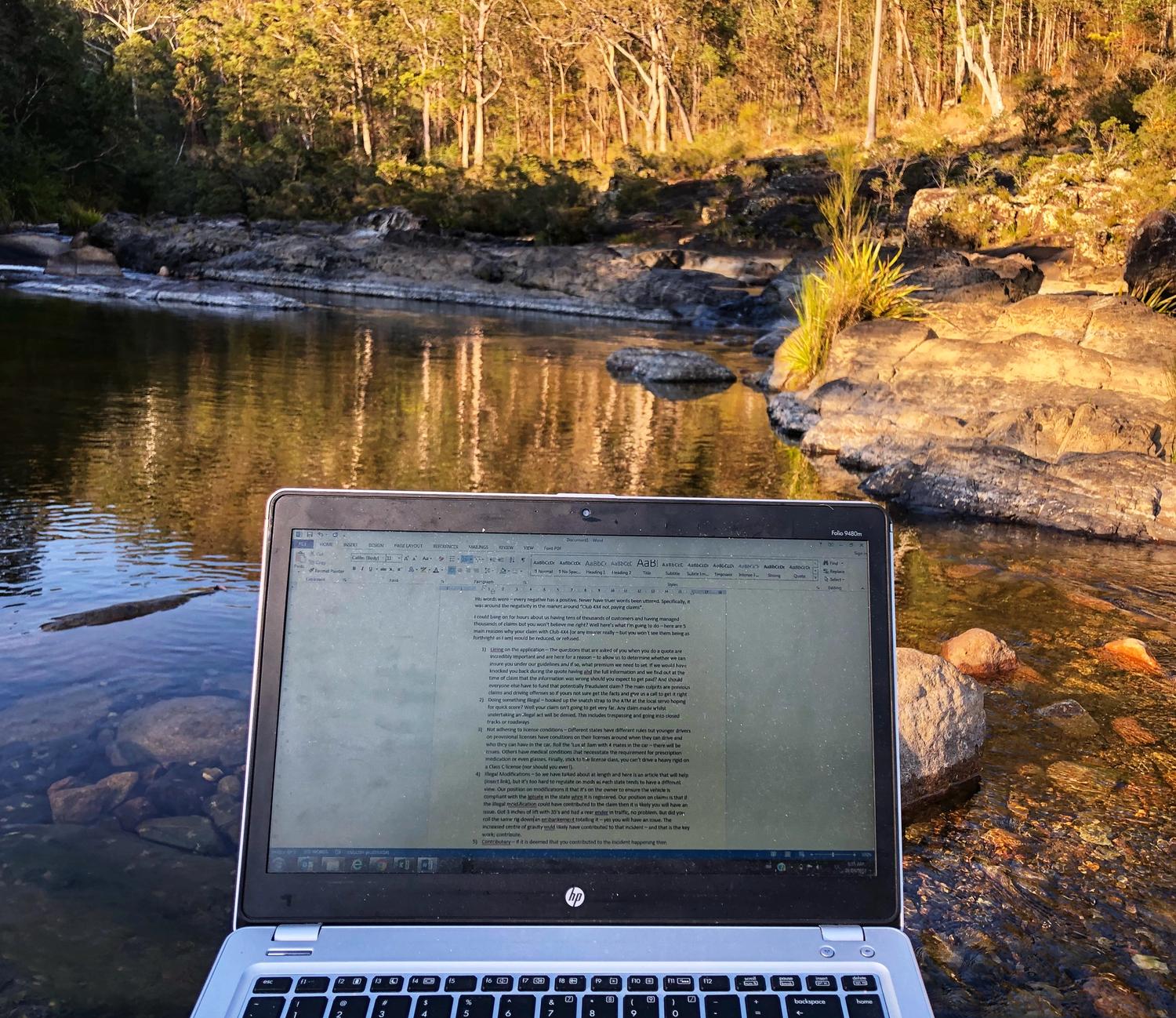

I’m sitting here telling myself that I’m supposed to be getting away from technology by being out here. It’s 6:30 am at the Junction campground just up near Coffs Harbour – a magnificent spot I hadn’t explored until now.

I owe the idea of this article to Ricko from The Offroad Adventure Show, you are the reason why I dragged myself away from my desk to go out for a few days – cheers mate.

His words were – every negative has a positive. Never have truer words been uttered. Specifically, it was regarding the negativity in the market around “Club 4X4 not paying claims”.

I could bang on for hours about us having tens of thousands of customers and having managed thousands of claims but you won’t believe me, right?

Well here’s what I’m going to do instead – I’m going to present to you the 5 main reasons why your claim with Club 4X4 (or any insurer really – but you won’t see them being as forthright as I am) could be reduced, or refused.

1) Misrepresentation – The questions that are asked of you when you do a quote are incredibly important. They allow us to determine whether we can insure you under our guidelines and, if so, what premium we need to set. If we would have knocked you back during the quote having had the full information and we find out at the time of claim that the information was wrong, is it right to expect to get paid? And should everyone else have to fund that potential claim? The main culprits are previous claims and driving offences, so if you’re not sure, get the facts and give us a call to get it right.

2) Doing something illegal – hooked up the snatch strap to the ATM at the local servo hoping for a quick score? Well your claim isn’t going to get very far. Any claim made whilst undertaking any illegal act will be denied. This includes trespassing and going into closed tracks or closed roadways.

3) Not adhering to license conditions – Different states have different rules, but younger drivers on provisional licenses have conditions on their licenses that stipulate when they can drive and who they can have in the car. Roll the ‘Lux at 3am with 4 mates in the car and on P Plates – we certainly hope everyone is OK, but there will be issues. Others have medical conditions that necessitate prescription medication or even glasses. Finally, stick to the license class, you can’t drive a Heavy Rigid on a Class C license (nor should you ever try!).

4) Illegal modifications – So we have talked about this one at length and here is an article that will give further context. Our position on modifications is that it’s on the owner to ensure the vehicle is compliant with the legislation in the state where it is registered. Our position on a claim is that if the illegal modification could have contributed to the claim, then it is likely you will have an issue. Got 3 inches of lift with 35’s and had a rear-ender in traffic, no problem. But did you roll the same rig down an embankment, totalling it – yes you will have an issue. In that specific example, the reason is because the increased centre of gravity would have likely contributed to that incident – and that is the key word; contribute.

5) Contributory – if it is deemed that you contributed to the incident, then there will almost certainly be issues with your claim. Left your keys in the car or the doors unlocked and it got stolen? Did all your 12v wiring yourself with incorrect gauge cable and no fuses? Was it shockingly revealed that you rolled your car off a cliff yourself or arranged for it to be stolen and burnt out? All of these are circumstances that could see your claim reduced or refused.

Something else to note is that where your claim is denied, this declination goes onto a central register and you will need to notify all prospective insurers of it. Should there be any potential fraud identified there is also a very real possibility of charges being laid and that tag landing next to your profile, which you will also need to declare for quite some time.

So looking at the above – are any of these circumstances unfair? Would you want to pay through your premium next year for the cost of someone who thought it was reasonable to get paid in these circumstances?

As mentioned above, if you’re not sure, check it and come back to us. The process of taking up insurance is entering into a contract – you wouldn’t misrepresent yourself on a contract with a bank or other organisation would you?

Hopefully this helps to bring some context and sense to what you may be seeing online.

Happy Touring

Kalen