Website Update: Glass Claim Declaration

Late last week we implemented an update in our online quoting system to attention an issue that was discovered through feedback from a number of you. We pride ourselves on being different, continuing to offer …

Late last week we implemented an update in our online quoting system to attention an issue that was discovered through feedback from a number of you.

We pride ourselves on being different, continuing to offer the 4X4 enthusiast with a product that cannot be replicated anywhere else in the market. Those in the know understand the difference and one of the reasons for our weekly Campfire newsletter is to help with the education process around these differences.

Sometimes what we do differently is taken as a positive and even at times, with disbelief. Then, at other times it may come as a more negative surprise which drives a lot of chatter around the campfire and online. At the core of this is the fact that to be as different, as we are in our product offering to the market, requires different processes to the market. One of these differences is what sorts of claims we consider as part of our “Underwriting criteria”. Those who’ve not read prior posts, these are in essence the criteria we utilise to first decide whether we can, in fact, provide you with cover and, if you are accepted, what premium we will offer.

It has surprised and at times antagonised people that we consider not-at-fault and Glass claims in this criteria. Why do we use this you ask? Well, we have covered the not-at-fault claims in our earlier article which you can read here. Glass claims, on the other hand, are specific to four-wheel driving. Usually the first response to this is stating that other insurers don’t recognise a glass claim as a motor claim – this may be the case yes, but will those insurers cover a brand new Patriot Supertourer for the money that is paid to purchase one, or would they see it as a standard 79 or 200 series? In the same vein, can you insure your fast approaching classic GQ or 80 series with the mods you’ve put into it in the 20 years you’ve owned it, without having to twist their arm? I dare say not, but happy to be corrected.

Glass claims are a massive part of the expenses incurred by our brand and it should be – all of our customers love to go off-road, not a small percentage like the other insurers noted above. We are here to tailor to that enthusiast. Road trains don’t slow down and the outback highways don’t get sealed and that’s the point of our passion.

As such, we consider glass claims to be a part of our risk rating criteria – simple.

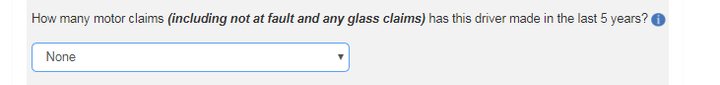

The feedback that we got was that this wasn’t clear enough – so we have now clarified the requirement to disclose Glass Claims in our system – as demonstrated below. As we have stated before, these details may be checked at the point of claim, so please ensure you abide by the Duty Of Discloser that you agree to at the start of any quote you do with us and disclose all claims that we ask for.

Thank you to everyone who kept bringing this issue up and providing us with feedback and opportunity to improve.

Happy Touring